Greetings!

I am an applied macroeconomist studying international economics and macro-finance, with a focus on how global financial markets interact with domestic monetary policy through financial frictions and institutional design. My job market paper uses a shift-share design—endogenous currency shares interacted with exogenous monetary shocks—to causally estimate the costs of sovereign defaults, finding sizable yet temporary impacts: real GDP per capita declines by about 8% on impact, peaks near 18%, and fades to zero by year 6, with substantially more severe losses under pegged exchange rate regimes.

My research combines modern econometric methods to answer macroeconomic questions from historical perspectives to uncover mechanisms that are difficult to observe in contemporary data. Methodologically, I specialize in using applied empirical tools—including local projections, VARs, instrumental variables, difference-in-differences, and Bayesian methods—to study sovereign debt markets, inflation-target credibility, and exchange rate puzzles. My second paper uses a sufficient-statistics approach, which combines impulse responses from Bayesian VARs with EIU forecasts, to evaluate the evolving credibility of monetary policy in emerging markets.

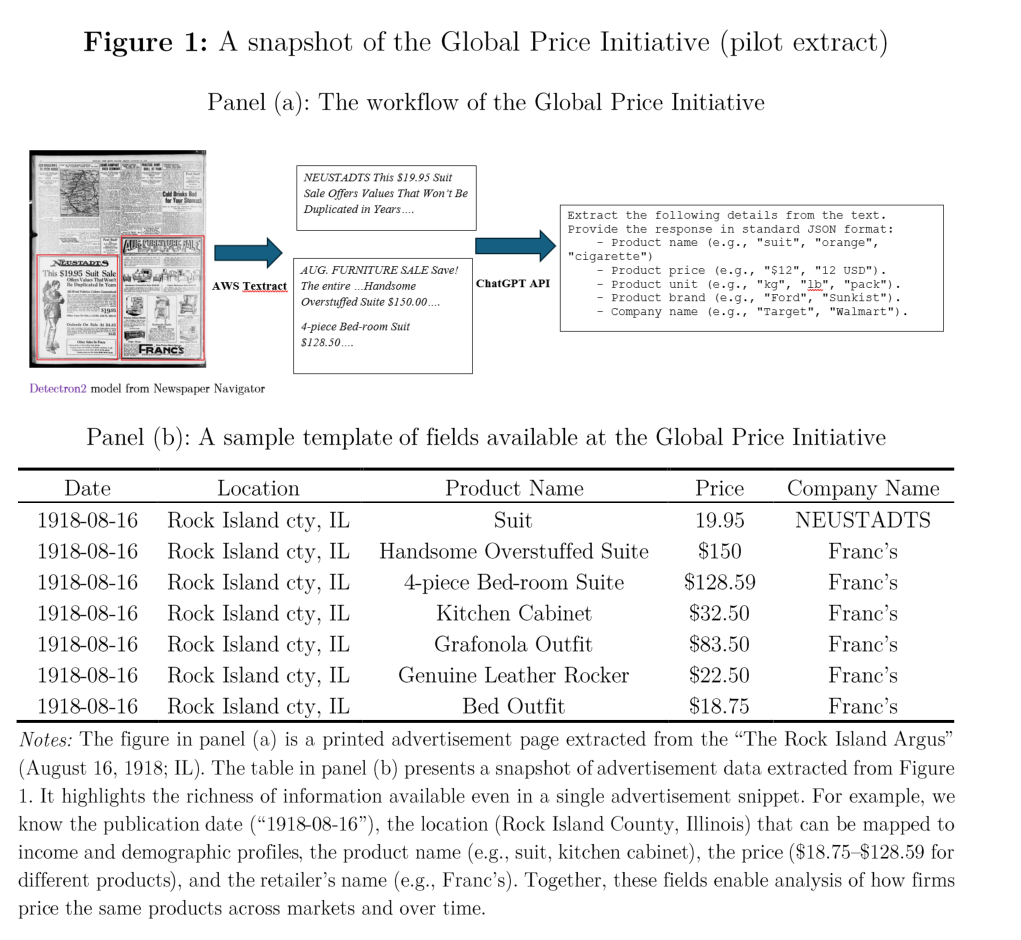

I am a committed instructor who seeks to make macro-finance and international economics accessible through historically grounded examples that speak to students from diverse backgrounds. I am deeply invested in undergraduate research mentorship, working closely with students through research assistantships and aspiring to supervise senior theses. I lead the "Global Price Initiative," which builds time-geography-product level price datasets from historical newspaper advertisements. Through both my teaching and research, I aim to integrate hands-on training in big data analysis, cloud computing, and applied AI tools, while helping students prepare for both research careers and data-intensive roles in finance and consulting industries.

Update (1/19): I have posted a new working paper, Evaluating Emerging Markets' Monetary Policy. A short non-technical summary is available here.

Research Interests: Macroeconomics, International Finance, and Applied Econometrics

Job Market Paper

Monetary Shocks, Currency Exposures, and the Cost of Sovereign Default

[Show/hide abstract] •

[Show/hide key results] •

[Non-technical summary]

[Current draft (November 2025)]

How costly is sovereign default? I develop a probabilistic sovereign default model that features (i) foreign monetary shocks induce self-fulfilling default equilibria; (ii) multiple equilibria imply a local average treatment effect; and (iii) under Fréchet heterogeneity in nominal exchange rates, default probability admits a shift-share form. Guided by these insights, I exploit aggregate variation in developing countries' currency denomination of external debt (endogenous shares) and advanced economies' quasi-random interest rate movements (exogenous shifts) to construct a shift-share instrumental variable (SSIV) for sovereign default decisions. Using a local projection–instrumental variable (LP-IV) approach, I causally estimate that sovereign defaults on average result in an 8% decline in real GDP per capita in the first year. The impact peaks at 18.5% around the second year, persists until the fourth year, and then fades toward zero by the sixth year. Moreover, I find that floating exchange rate regimes and lower external debt levels, especially short-term debt, effectively attenuate the output loss. Narrative monetary shocks and difference-in-difference analyses yield similar results, further confirming that sovereign default is indeed costly.

Working Papers

(New!) Evaluating Emerging Markets' Monetary Policy

[Show/hide abstract] •

[Show/hide key results] •

[Non-technical summary]

[Current draft (January 2026)]

Are emerging markets' central banks credibly committed to inflation targeting? This paper applies the ``Optimal Policy Perturbation'' (OPP) framework of Barnichon and Mesters (2023) to evaluate monetary policy credibility across emerging economies. Combining impulse responses from a Bayesian VAR with professional forecasts from the Economist Intelligence Unit, I exploit the dual interpretation of the OPP statistic. First, under the assumption that observed policy rates are locally optimal given policymakers' information sets, I adopt a revealed-preference approach and recover time-varying implicit policy weights by minimizing deviations of the OPP statistic from zero. Second, under fixed benchmark weights, I use the OPP statistic to assess whether policy rates could have been adjusted to further reduce the policymaker's loss, and to quantify the direction and magnitude of such adjustments. The evidence indicates that inflation-target regimes in emerging markets have become increasingly credible since the early 2000s, with stronger anchoring of inflation expectations and reduced inflation persistence. While central banks face sharper trade-offs during global crises, monetary policy behavior typically reverts toward inflation stabilization, highlighting the flexibility and resilience of modern inflation-target frameworks.

Work in Progress

Currency Denomination of External Debts

[Show/hide abstract] •

[Show/hide key results]

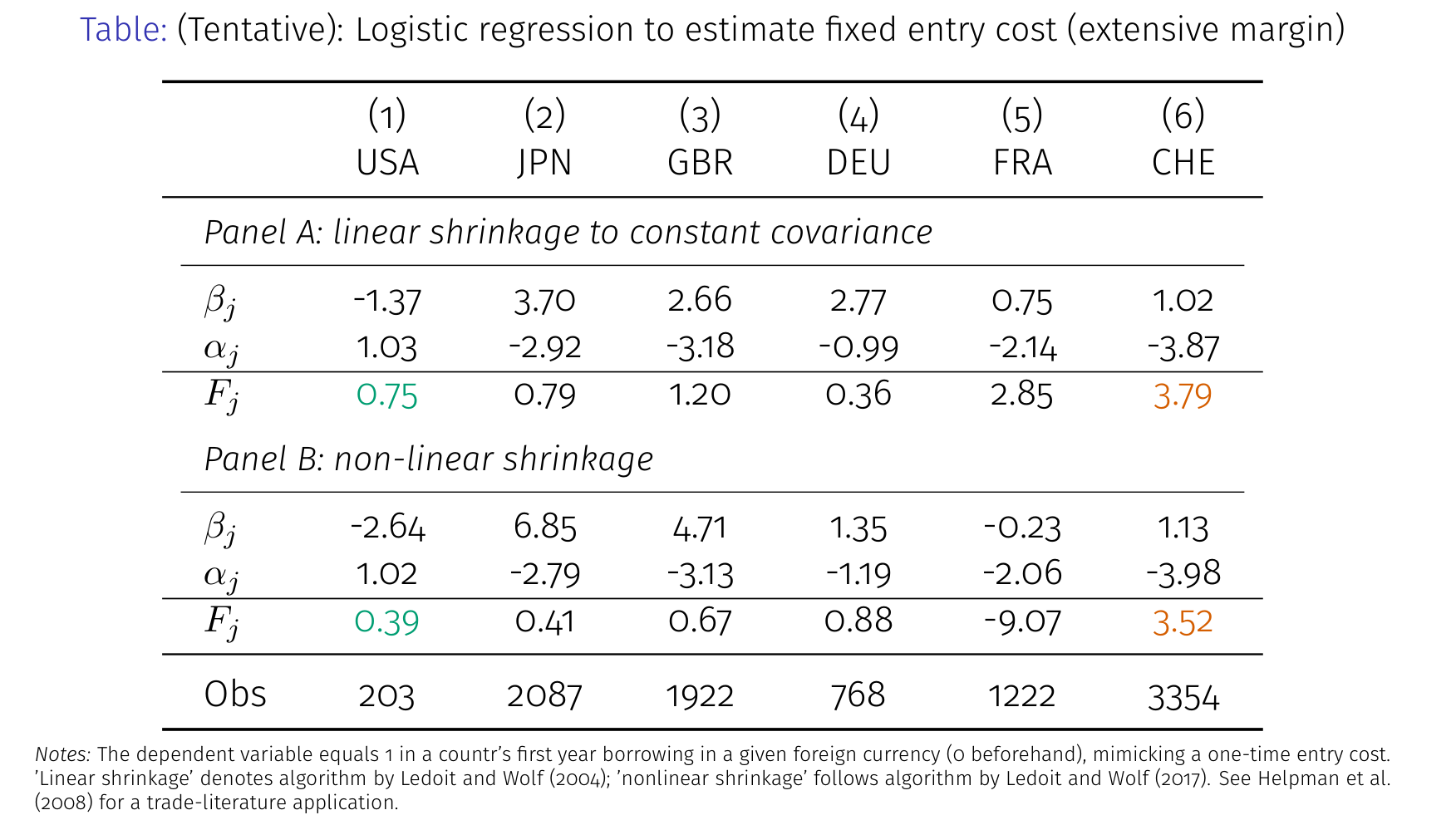

Why do developing countries borrow predominantly in foreign currency rather than domestic currency (i.e., the "original sin")? Why is most external debt denominated in the U.S. dollar rather than other advanced economies' currencies? Since the currency denomination shapes emerging markets' balance-sheet exposure to the hegemon's monetary spillovers, understanding its determinants has direct policy implications for debt sustainability and financial market stability. This paper brings the trade literature—the Melitz (2003) model and Eaton-Kortum (2002) model—to bear on whether models that explain bilateral trade flows also account for the currency denomination of external debt. To rationalize the empirical fact that most external debt is denominated in U.S. dollar, I introduce non-negligible fixed entry costs of borrowing in an additional currency. From a finance perspective, I also incorporate an optimal portfolio choice model to assess consistency with the trade mechanism. The key insights highlight the importance of trade frictions in the international borrowing markets, which include (i) the fixed-cost margin generates threshold behavior in currency adoption (extensive margin), and (ii) the heterogeneous creditors generate strategic complementarities, so small cost-push shocks need not necessarily overturn currency denomination shares.

The Price of Everything Everywhere

[Show/hide abstract] •

[Show/hide key results] •

[Non-technical summary]

[Preliminary draft (October 2025)]

This research project develops a novel historical dataset on prices of tradable goods and non-tradable services (occupation-level wages), returns on financial assets (bank deposit rates across maturities), as well as firms' balance sheets, across U.S. counties and international borders from 1850 to 2000. Using advanced machine learning methods, I examine printed advertisements from millions of digitized historical newspapers in order to shed light on (i) price stickiness and firms' markup structures at both domestic and international scales, (ii) the heterogeneous and distributional effects of macroeconomic policies—such as tariffs and monetary shocks—on realized inflation experienced by households from different income groups and demographic compositions across geographies, and (iii) the differential factor prices for capital and labor (e.g., interest/mortgage rates across maturities, and offered wages across service occupations) in different regions. The resulting “Global Price Initiative” database provides researchers with a highly detailed, product-level dataset that supports transparency, replicability, and versatility in macroeconomic and international research on prices.

Publications

Zombie lending, labor hoarding, and local industry growth

with Masami Imai (Wesleyan University)

Japan and the World Economy, Volume 71, (September 2024)

[Show/hide abstract]

[Published version]

After the bursting of real estate bubbles in 1991, Japanese banks continued lending to unviable firms to conceal problem loans. We revisit Japan's experience and propose a new mechanism via which banks' loan-evergreening policy undermines allocative efficiency across industries by focusing on construction and real estate loans. Namely, banks' continuing support for construction and real estate firms encourages labor hoarding in unviable construction projects. Since construction projects predominantly use low-skilled workers, banks' loan-evergreening policy in these troubled sectors may depress other low-skilled industries. Based on the industry-level data in each of Japan's 47 prefectures from 1992 to 1996, we document empirical facts consistent with this hypothesis. On average, low-skilled industries experienced disproportionately slower output and employment growth and more sluggish growth in the number of new establishments in prefectures where the share of bank loans to local construction/real estate sectors increased more after construction boom ended.